How to Change Income From Continuing Operations to Earnings Per Share

- Definition and explanation

- Formula of basic EPS

- Basic EPS with preferred stock

- Example

Definition and explanation

What is earnings per share?

Earnings per share (EPS) means the income earned by each common share of a company. It is computed only for common stock and sometimes referred to as earnings per common share. EPS is an extensively used metric to evaluate profitability performance of commercial entities and receives much attention in financial news and discussions worldwide. Due to its significance for investors and other decision makers, many countries and states require publicly held commercial entities to calculate and report their EPS number in published financial statements. Public companies mostly disclose this number in their income statement immediately below the net income line.

However, the EPS disclosure is not mandatory for nonpublic entities because their securities are not traded in a public or over-the-counter market and they are not required to file their financial statements with securities and exchange commission (SEP).

Types of earnings per share

Earnings per share (EPS) is of two types – (i) basic earnings per share (BEPS) and (ii) dilutive earnings per share (DEPS). Which type of EPS a company needs to report in its financial statements depends on its capital structure. The companies with simple capital structure report only basic EPS whereas those with complex capital structure are required to report both basic and dilutive EPS numbers. This article exemplifies the computation and reporting of basic EPS only. Let's start with its definition.

Basic earnings per share (or basic EPS) may be defined as the amount of income allocable to a single share of a company's common stock calculated without taking into account the potential impact of any dilutive security or securities the company may have outstanding in its capital structure.

Formula of basic earnings per share (BEPS)

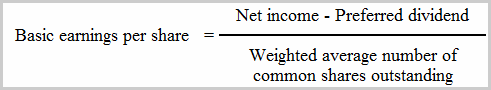

The computation of basic EPS is simple and easier than dilutive EPS. It involves two items – net income and weighted average number of shares outstanding. The formula of basic earnings per share is given below:

Net income/Weighted average number of shares outstanding

For example, David corporation earns a net income of $600,000 for the year 2022. If its weighted average number of common shares outstanding is 300,000, its earnings per share would be $2 (= $600,000/300,000 shares). David would report this EPS in its income statement as follows:

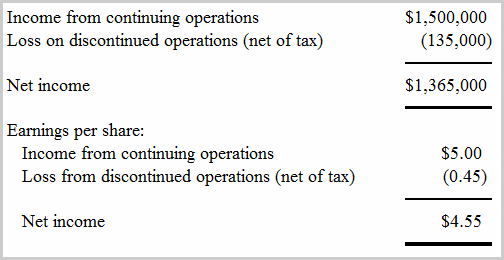

If a company has intermediate components of income or loss, like income or loss form discontinued operations, it must report EPS for each component separately. For example, suppose, next year David Corporation generates an income of $1,500,000 from its continuing operations and incurs a loss of $135,000 from discontinued operations. If David's weighted average number of shares outstanding does not change and remain the same (i.e., 300,000 shares) till the end of the next year, it would compute and report its earnings per share from continuing operations and loss per share from discontinued operations as follows:

Earnings per share from continuing operations:

Income from continuing operations/Weighted average number of shares outstanding

= $1,500,000/300,000 shares

= $5.00

Loss per share from discontinued operations:

Loss from discontinued operations/Weighted average number of shares outstanding

= $135,000/300,000 shares

= $0.45

The reporting of income from continuing operations, loss from discontinued operations and EPS in David's income statement would be done as follows:

The disclosures like above help stockholders and other users of financial statements in recognizing the impact of both continuing and discontinued operations on earnings per share of the entity.

Basic EPS with preferred stock

Up to this point, we have not taken into account the impact of preferred stock on EPS computation. Let's incorporate the dividend on preferred stock in our discussion and see how it impacts the basic EPS formula and computation.

When a company's capital structure contains preferred stock, the numerator of the formula includes preferred dividend in addition to net income. The modified formula of basic EPS is given below:

Since the EPS number belongs to only common stock, we subtract preferred stock dividend from net income in the numerator part of the formula to obtain the amount of net income available to common stockholders. In case of loss, the preferred dividend is added to increase the amount of net loss.

You might need to learn the following four important points about preferred stock dividend in relation to EPS computation:

- If preferred stock is cumulative, the company must deduct from net income or add to net loss an amount equal to current year's preferred dividend even if it does not declare any preferred dividend during the period.

- Unpaid preferred dividend belonging to one or more previous periods (known as dividends in arrear) is not deducted from net income or added to net loss. It is only the current year's preferred dividend that needs to be taken into account for EPS calculation. The dividends in arear should have already been considered in previous years' EPS computation(s).

- In case the preferred stock is non-cumulative, the preferred dividend is considered for EPS calculation only if it has been declared during the period. If management does not declare any dividend on non-cumulative preferred stock, there is no dividend amount to deduct from net income.

- If income or loss from discontinued operations exists for a period, the preferred dividend impacts income or loss from continuing operations only. It does not impact the income or loss from discontinued operations.

Let's exemplify the computation of basic earnings per share with preferred stock.

Example

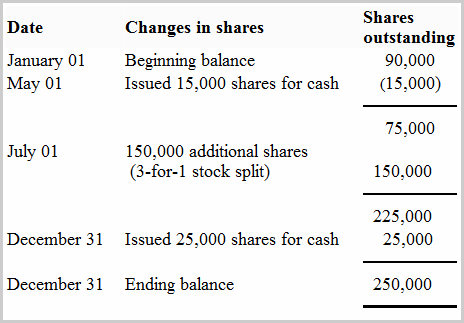

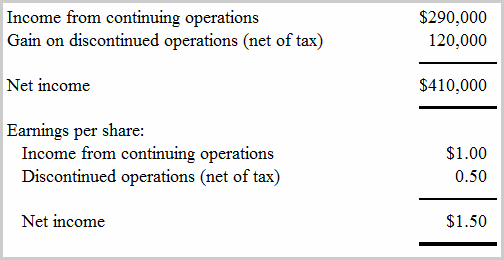

Mega Inc. has earned an income of $290,000 from its continuing operations and its gain from discontinued items is $120,000 (net of tax). The Inc. has declared a preferred dividend of $1 per share on its 50,000 shares of preferred stock outstanding. The following changes has taken place in its shares of common stock during the year 2022.

Required:

- Compute Mega's weighted average number of shares outstanding.

- Compute basic earnings per share for both continuing and discontinued operations of Mega Inc.

- How the Inc. would report EPS on the face of its income statement?

Solution

1. Computation of mega's weighted average number of shares outstanding:

25,000 shares issued on December 31, 2022 have been ignored in above computation because these shares have not been outstanding during the year.

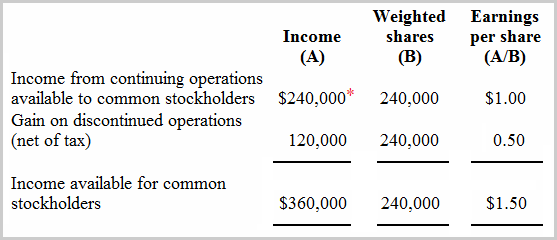

2. Computation of Mega's basic earnings per share:

*Income from continuing operations available to common stockholders:

Income from continuing operations – preferred dividend declared

= $290,000 – $50,000

= $240,000

Notice that the preferred dividend of $50,000 has been subtracted from the income from continuing operations without impacting the gain on discontinued operations.

3. Disclosure of Mega's basic earnings per share on the face of its income statement

Source: https://www.accountingformanagement.org/basic-earnings-per-share/

0 Response to "How to Change Income From Continuing Operations to Earnings Per Share"

Post a Comment